Investment decisions are not the kind that you make in a hurry. You must ensure that you have comprehensive knowledge about the potential investment. This article serves as a manual to provide all you need to invest in Dogecoin.

Concise Overview

- Proper knowledge of a cryptocurrency is required before deciding to invest.

- You must understand a cryptocurrency’s history and other factors that affect its price.

- While investing, you also need to take proper measures to secure your capital and maximize profit.

- Armed with these bits of information, you can make calculated investment decisions.

Introduction

You probably didn’t know that there are over 20,000 cryptocurrencies, but only about half of them are active. Exploding Topics estimates the number of active cryptocurrencies to be almost 47 shy of 11,000. Typically, cryptocurrencies are supposed to fulfill a purpose that determines their perceived value and attracts investors. However, of all of the existing cryptocurrencies, only a few have a fundamental innovative proposition that makes them worth investments.

The more people think a coin has value, the more they interact with it, increasing its value. So, if you want to invest in a cryptocurrency, an excellent place to start would be tokens with the highest market cap. According to data from CoinMarketCap, the top 10 and 20 cryptocurrencies make up about 82 and 88% of the total cryptocurrency market cap, respectively.

This article extensively discusses one of the oldest and highest performing cryptocurrencies, Dogecoin. It covers everything from the coin’s history, value, and factors to consider before investing.

What is Dogecoin, and How Does it Work?

Dogecoin was created and launched by Billy Markus and Jackson Palmer in 2013 as an open-source, peer-to-peer cryptocurrency that supports decentralized payment on the Dogecoin network. At the time, Jackson and Billy worked in different organizations (Adobe and IBM, respectively). However, they shared a similar interest in developing a technology that defied the traditional banking model and allowed people to perform instant transactions efficiently.

Dogecoin wasn’t the first coin to provide these offerings. Other cryptocurrencies, at the time, allowed people to make easy transactions. However, Dogecoin had a fun concept which made it attractive to cryptocurrency enthusiasts. The coin was the fork of a fork that was the fork of a fork. If reading the last sentence spiked a different emotion in you, you have successfully time traveled to feel how people perceived Dogecoin in 2013.

Dogecoin was a hard fork of Litecoin (LTC), Litecoin was a hard fork of the no-longer-existent Luckycoin, and Luckycoin was a hard fork of the novel Bitcoin. Basically,

Bitcoin >>> Luckycoin >>> Litecoin >>> Dogecoin

The coin also used Shiba Inu, a Japanese hunting dog, as an emblem, giving it a public persona as a meme coin. This coin became a source of humor for many, attracting more people to the cryptocurrency industry and increasing the number of people actively trading or holding the coin.

How Does Dogecoin Work?

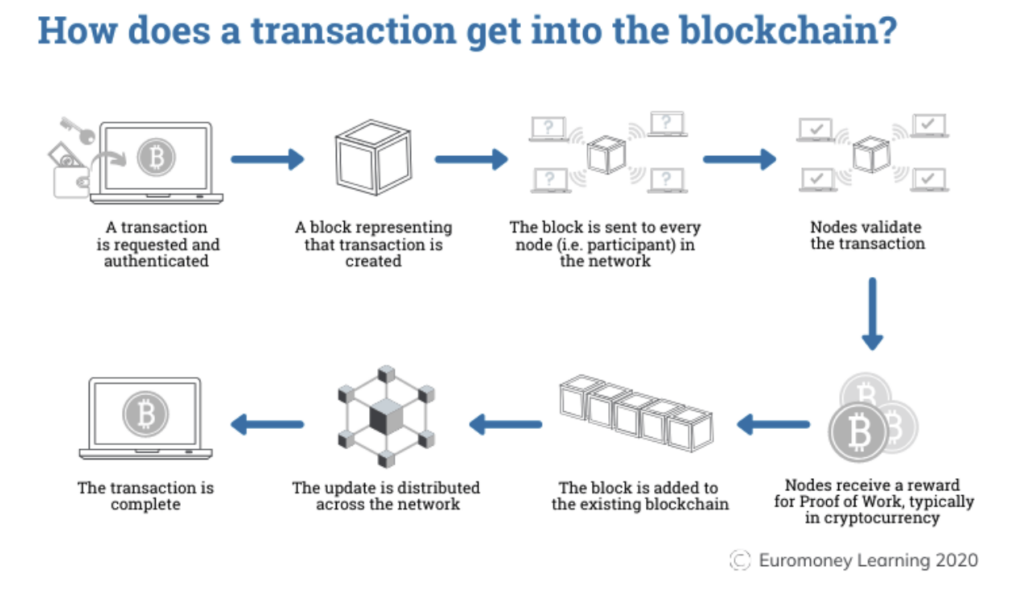

Dogecoin is powered using the proof-of-work consensus mechanism, a blockchain operational model that allows certain people to verify transactions and earn rewards. In the proof-of-work consensus mechanism, different computers work to make an intensive effort to generate a hash and add new blocks of transactions to the blockchain.

In lay terms, proof-of-work means a block needs to be verified, and several computers are eligible and available to perform the verification. To be fair, all computers are given a task and they need to expend a lot of energy to complete the task. The first computer to complete this task submits a “proof-of-work” and is rewarded with native tokens of that blockchain. In the Dogecoin network, miners are rewarded with 10,000 DOGE.

How Many Dogecoins Are There?

After it was created, the Dogecoins total supply was capped at 100 billion DOGE. However, a few months after launching the coin, the cap was removed, making the total supply of DOGE infinity. According to data from CoinMarketCap, there are 132.67 billion in circulation at the time of writing.

As an inflationary token, Dogecoin’s coin is supposed to keep losing its value as its supply increases. However, the coin has been able to pull a decent amount of supporters and developed a strong community of followers using the Dogecoin network to execute transactions and participate in non-competitive mining. This active participation, alongside the ripple effect of a bull run and endorsement from celebrities like Snoop Dogg and Elon Musk, has helped the coin maintain a relatively high price over the years.

History of Dogecoin

In 2010, a Japanese woman posted a picture of Kabosu, her Shiba Inu dog, on her blog. Little did she know that her eight-year-old pet would become an internet sensation and the face of the doge meme three years later. In 2013, Kabosu was photoshopped to create memes and crack internet jokes.

At this time, Bitcoin was beginning to gain dominance, and there were as many supporters as there were doubters of the cryptocurrency. Because Bitcoin was open-source, people took their chance to create parody coins. Jackson Palmer and Bill Markus also joined the bandwagon and created a parody—Dogecoin. As explained earlier, Dogecoin is a parody of a parody that is a parody of Bitcoin.

However, unlike other parodies, the creators of Dogecoin wanted to be different. They wanted to garner much attention from the public without being a victim of cryptocurrency backlash. To achieve this, they used the doge meme as a logo for their coin. The creators also adopted the meme’s name for the name of their coin – Dogecoin.

Taking advantage of a mainstream controversy and the world’s most popular meme at the time was an excellent and timely decision for Bill and Jackson. As soon as they released the cryptocurrency, they were able to attract over one million people in their first week. That’s an impressive amount for a startup, even in today’s world.

The value of Dogecoin increased by over 300%. This happened during a time when the cryptocurrency market was wobbling. The price continued to grow steadily, and nothing spectacular occurred until 2018.

Jackson Palmer Saga

The coin had just crossed a $1 billion market cap, and Jackson Palmer was worried about how a coin with no technological innovation or recent software update could cross such a colossal milestone. He dissociated himself from the coin, saying cryptocurrency was a bubble doomed to burst. This news affected Dogecoin’s price for a few days, but the cryptocurrency market was in a bull run, so the coin was quick to gain stability again.

2021: Moving To The Moon

2021 was another excellent year for the Dogecoin blockchain and everyone within the ecosystem. Tiktok had gained wide acceptance during the COVID-19 lockdown, with over 1 billion registered users. A trend promoting Dogecoin and trying to push its value to $1 became viral, and it spread to other social media applications like Reddit and Twitter.

While this was happening, a few celebrities also showed support for the growth of the coin and used their influence (in no small way) to pump the price. Elon Musk, Tesla’s CEO, was one of these celebrities. Elon had long supported Bitcoin, and seeing him support another coin indicated buying for many people. Snoop Dogg and Gene Simmons also showed solid support for Dogecoin at this time and attracted a lot of attention. The cryptocurrency was able to climb above 50 cents to an all-time high of $0.6848 before falling down the charts.

Investing in Dogecoin

Using CoinMaketCap’s chart data, Dogecoin rose from about 0.5 cents in January 2021 to more than 68 cents in May—a percentage increase of 13,500%. Before its eventual fall, the coin performed better than Bitcoin and Ethereum, making it a good investment option. However, Ethereum recently left the list of cryptocurrencies using the proof-of-work consensus mechanism. This action paved the way for Dogecoin to become the second-largest proof-of-work after Bitcoin. There are speculations that this could be good news for the blockchain, increasing the coin’s value.

If you are among these Dogecoin optimists or have other reasons why you think Dogecoin is a good investment, we’ll discuss ways to invest in Dogecoin shortly. However, you must first have Dogecoin before you start investing, and here are a few ways you can buy Dogecoin;

- Find A Reliable Cryptocurrency Exchange

Cryptocurrencies are digital assets; hence, they can not be bought or sold over the counter. The only place to get cryptocurrencies like Dogecoin is from a cryptocurrency exchange platform. Forbes estimates that there are almost 600 crypto exchange platforms where you can trade your tokens. However, just a few of them are reliable. Finding and trading with reliable platforms to avoid being scammed or losing your money.

- Choose a Payment Option

Cryptocurrency adoption is constantly growing more prominent. Hence, more payment services are beginning to integrate with cryptocurrency exchanges to enable seamless transactions. You can choose to make a bank deposit, use your credit card, do a wire transfer, etc. After choosing your most preferred option, deposit the amount you want to use to buy Dogecoin in your cryptocurrency wallet.

- Place an Order

When you have your dollar equivalent in your cryptocurrency wallet, you can now swap for Dogecoin. Find the EXCHANGE section on your chosen platform and check for the “DOGE” or its symbol. Select the amount of Dogecoin you want to buy and initiate a transaction. The transaction would typically be processed instantly, and you wouldn’t need to wait for a bank to process your transaction for days. You can also perform this transaction at any time in the 24 hours of 7 days.

- Store Your Crypto

After buying your Dogecoin, you can choose to leave it in your crypto exchange wallet. You can also move it to a decentralized wallet. However, centralized and decentralized wallets are susceptible to cyber-attacks and crypto fraud. If you want to keep the coin for an extended period, it would be best to keep it in cold storage, where the chances of being hacked are as slim as zero.

Now you have enough Dogecoin in your wallet and are ready to invest. Here are several ways you can invest in Dogecoin.

- HODL: HODL is a crypto slang that means to buy and hold a cryptocurrency until the value increases, and you can sell it off for profit. Hodling cryptocurrencies is the best and safest way to invest in your cryptocurrency. The risks are minimal, and you can always withdraw your money to fiat whenever you need.

- Trading: If you want to make money faster with Dogecoin, you can trade it against tokens like ETH, BTC, XRP, etc., or stablecoins like USDT, USDC, etc. Depending on your trading skill, you can trade Dogecoin in spot or futures.

- Dollar Cost Averaging: This investment strategy involves buying the same amount of a cryptocurrency at regular intervals, irrespective of price fluctuations. For example, you buy 100 Dogecoin or $100 worth of Dogecoin every day, whether the price increases or decreases. The strategy holds that after buying for an extended period, the average cost will be less than the market price, leaving you with profits.

- Divergence and Convergence: Also known as the Golden or Death cross, Divergence and Convergence are moving averages used to predict the market’s direction. Using these two tools, you can decide to buy or sell depending on where the market is headed.

- RSI Divergence: RSI Divergence is an investment strategy used to find market reversals and trade them. As in any human-controlled market, whenever there is a large momentum in market price, there will surely be a reversal before the market continues in the direction of the momentum. You can use RSI Divergence to spot the reversals in Dogecoin’s price and accumulate profit.

Where can I Buy Dogecoin?

Unlike other cryptocurrencies like Bitcoin and Ethereum, Dogecoin is not sold on all cryptocurrency platforms. Coinbase and BlockFi are examples of crypto exchange platforms that do not trade Dogecoin. However, here are a few places where you can buy Dogecoin for a fair price.

- Binance

- Crypto.com

- Robinhood

- WeBull

- eToro

- Uphold

- Kraken

You don’t need to use all of these platforms to trade Dogecoin. You need to choose one or two, and there are specific factors that can help you make this selection.

- Trading Volume: High trading volume on a crypto exchange platform indicates that the platform has a good reputation. Also, the number of activities affects market liquidity and determines the spread. Spread is a trading feature that determines how easy it is to enter or exit the market when you are trading. Platforms with low spread and high market liquidity are an excellent choice.

- Trading Fees: The price of Dogecoin on different platforms will vary, as well as the fees involved in trading. Each platform offers investors different rates based on the amount of money they bring into the market. When looking for the right platform to trade with, consider the platform with the best rates for the kind of money you are using.

- Reputation: One of the core features to confirm before using a crypto platform is its reputation. Check online to see what past users have said about the platform. This will help you to know what platform is reliable and can help you resolve disputes if any arise.

- Regulations: Centralized exchange platforms must know your customer (KYC) and Anti-Money Laundering (AML) practices to protect customers’ interests. Ensure that whichever platform you decide to use has regulations in place to meet KYC and AML regulations.

Is Dogecoin a Good Investment?

Dogecoin, like other cryptocurrencies, is a high-risk investment, and you should only invest a small percentage of your investment portfolio in crypto. Many factors make a Dogecoin a good investment; some of them include;

- Public Engagement: Are many people trading this coin now, and is there a chance that more people will start trading this coin soon?

- Endorsements: When people with a good reputation begin to endorse a coin, it is sometimes a good indication to buy and anticipate a price increase.

- News: Certain occurrences can trigger cryptocurrency’s short- or long-term price. China banning cryptocurrency led to a decrease in bitcoin’s price, but when Tesla announced that they would accept Bitcoin as a means of payment for their cars, Bitcoin’s price increased.

- Technical Analysis: History repeats itself, even in the cryptocurrency market. You can study and analyze market charts to predict how the price will react based on past reactions.

Evaluating these factors concerning Dogecoin will enable you to reach an investment decision. By focusing on these metrics, you will almost correctly decide whether to hold on to your investment, invest for a short term, or wait an extended period.

Should I Invest in Dogecoin?

There is no foolproof answer to this question. The decision to invest in Dogecoin largely depends on when you want to invest, how much you are willing to invest, and how long you are willing to let your investment generate profit. Hence, it is best if you research properly before deciding. Watch out for market volatility and manage your risk, so you don’t lose your capital. If you lose, don’t try to let your emotions get the best of you by trying to take revenge on the market. Take a calculated move and always invest what you can afford to lose.