Terra (LUNA) is the Terra project’s second blockchain expected to hold a new prospect for investors in its network. Its model continues to be worked on and improved to meet investors’ market expectations in time.

Concise Overview

- Terra (LUNA) is a decentralized project that focuses on the stablecoin protocol

- LUNA is Terra’s native token for governance and staking

- The Terra network has been integrated into a new blockchain (Terra 2.0) following the crash of the project’s first blockchain

Introduction

Terra (LUNA) is a token that seeks to address decentralized finance (DeFi) issues through a stablecoin. A stablecoin is a digital currency that promises to keep its value constant, often pegged to fiat money and other commodities.

Most stablecoins’ values are tied to something else already stable instead of relying on market speculation, and Terra (LUNA) is no exception. They are backed by a financial reserve or short-term debt, which means the price of a stablecoin always equals the value of its backing asset. Because of their lower volatility, stablecoins serve as the primary medium for transferring funds between digital tokens or converting them into fiat money.

While there are several stablecoins, few can claim to have been built with a native token that gives stakeholders more control over their proof-of-stake (PoS) consensus protocol. Fewer can claim that it makes users less vulnerable to drops in the value of the fiat asset to which they are linked.

If you want to invest in a blockchain project with a strategy that offers a more risk-adjusted advantage than the average stablecoin, learning more about Terra could be beneficial.

What is Terra?

Terra is a blockchain network with no permissions and borders that focuses on the stablecoin protocol. By tying Terra to fiat currencies, it can hedge against cryptocurrency volatility.

The native staking token, LUNA, reduces volatility caused by fluctuations in the value of fiat currencies. The mission of LUNA is to control Terra’s supply (primarily available in the market as TerraUSD or UST). As a result, it has a firm grip on its market value.

Terra uses the Tendermint delegated proof-of-stake consensus protocol to create new blocks. It involves the participation of two key players: the validator that burns LUNA into a Terra stablecoin denomination for a commission; and the elevator that offers LUNA tokens to be traded by a validator in the blockchain. It’s easy to think of the validator as a broker and the delegator as a security investor.

Brief History of Terra

Do Kwon and Daniel Shin developed Terra in 2018 as an algorithm-based stablecoin. They created the blockchain through a fintech business named Terraform Labs, situated in South Korea. In 2019, the developers outlined Terra’s whitepaper working and defined its features thus:

- Terra’s focus will be on price stability and consistent value growth.

- The blockchain will adopt fiat and Bitcoin to create a more controllable demand-supply during economic fluctuations.

- It will integrate a fiscal policy with the commonly used monetary policy in blockchain networks through arbitrage between validators and delegators.

With the process set out, Terra became one of the most successful decentralized finance coins in subsequent years. Its market cap reached over 280 billion USD. However, its value decreased after the most recent crypto security pan-market meltdown. It caused it to plunge from a peak of more than $117 in April 2022 to a mere cent, shocking the cryptocurrency market.

After this crash, a coin that had previously been ranked seventh in market capitalization fell to the 214th position as of June 1, 2022. The stakeholder’s assets were lost in this disaster for about US$18 billion, but it also ushered in Terra 2.0 — a relaunch of the first Terra blockchain, which has now been termed ‘Terra Classic.’ Therefore, a new blockchain was created with its cryptocurrency.

Terra LUNA 2.0 and Terra Classic (LUNC)

Due to their close resemblance, the project designations Terra LUNA and Terra Classic (LUNC) might be difficult to distinguish. However, it’s important to remember that Terra is the moniker for the decentralized blockchain network that allows for trading and arbitrage.

After the Terra network and its tokens crashed, the community endorsed a revival plan to relaunch the project, creating an entirely new chain with some new names. As a result, two terra blockchains are operating concurrently.

- The recently released blockchain with the native token Terra LUNA

- The old (original) Terra network with the token renamed LUNA Classic (LUNC) and UST tokens (LUNA).

| Terra Classic (LUNC) | Terra 2.0 (LUNA) | |

| Founding Year | 2018 | 2022 |

| Founder | Do Kwon & Daniel Shin | Do Kwon |

| Current Market Price | 0.0000881 USD | 1.6440766 USD |

| Market Capitalization | 579.65M USD | 209.58M USD |

| Circulating Supply | 127.48M USD | 6,579.72B USD |

Terra Classic is the term given to the old and algorithm-based Terra blockchain. Its native token has also been named LUNA Classic (LUNC). Terra LUNA 2.0 is the name of the new Terra blockchain created after the catastrophic drop in the value of Terra Classic. Its native token is similarly termed LUNA 2.0 (LUNA).

Terra Classic and Terra LUNA 2.0 are live blockchains. However, Terra Classic is redundant as most users have integrated their funds to Terra LUNA 2.0 through the LUNA airdrop distribution. New developments are expected to be seen in Terra LUNA 2.0 as its development community will be working to establish new DApps to run the new blockchain more effectively.

LUNA: Terra’s Native Cryptocurrency

LUNA is a native cryptocurrency of Terra, intended for use in trade and as a store of value. In addition, it controls the flow of UST and other Terra stable currencies. It also serves as a fiscal tool through which Terra’s value is controlled if the prices of the fiat assets to which it is linked decline, most notably the USD, its default fiat currency.

Additionally, because LUNA enables users to participate in blockchain governance as active validators who vote on behalf of the delegators to create new blocks, it serves as the hub of the Terra network’s consensus mechanism.

Is Terra (LUNA) a Smart Investment?

The Terra stablecoins as an ideal investment have led to many controversies. Since the cryptocurrency’s unanticipated, catastrophic crash in value on May 9, 2022, a de-peg of UST from USD occurred. However, some investors are of the fact that its fall in price does not rule out its potential to scale up in value, as cryptocurrencies are highly volatile.

A good number of experts predict that Terra LUNA will experience a gradual increase in value in the next decade. But these are not absolute answers to the cryptocurrency’s future value, as the blockchain is governed under a purely decentralized protocol which is relatively fuzzier to predict.

How many of the multiple protocols and development teams established on the previous network will maintain their loyalty and continue to create apps is the question facing the new Terra blockchain. One of the many popular blockchain networks with a significant price decline in the first half of 2022 is Terra LUNA. The new blockchain’s activity and use cases, however, will ultimately decide its worth and viability.

Regardless, there are many reasons to consider investing in Terra LUNA 2.0, which will be discussed below:

Growth of Decentralized Finance

DeFi, a subcategory within the larger crypto space, provides many of the mainstream financial world’s services in a way controlled by the masses rather than a central entity or entities. The recent global drop in cryptocurrency prices has undoubtedly reduced the consolidated value of DeFi assets from an estimated $280 billion in the second half of 2021 to around $80 billion. Despite this, Defi tends to hold up, which would benefit Terra LUNA. DeFi applications (dAPPs) now have numerous use cases, allowing participants to save, invest, trade, and engage in market making, among other things.

Excellent Interoperability

Terra (LUNA) is a highly compatible blockchain due to its extensive decentralization. Its architecture enables its native tokens to be traded on other blockchains such as Solana and Ethereum. This means investors can quickly transfer assets from Terra to other chains and vice versa. This capability is essential as it has the potential to attract more users who would like to take advantage of opportunities that arise periodically on protocols on different blockchains.

Earn Interest from Staking

As a delegator in Terra (LUNA)’s blockchain, you can stake its tokens for a reward during your arbitrage with a validator. A ‘validator’ is someone who assists in the verification and proposal of new blocks of transaction data. They receive a commission fee from network stakeholders in exchange for their efforts. Any LUNA holder can delegate their coins to a validator without meeting the stringent validator requirements and still earn rewards.

Opportunities for Arbitrage

Terra (LUNA) also allows you to arbitrate with multiple validators simultaneously. Arbitrage is a strategy where you buy low on one exchange and sell on another at a higher price. You can hedge your staking by staking your LUNA tokens to multiple validators or just one. The system provides significant investment flexibility by allowing you to control how you risk your funds, even when they are passively traded (as you do not have to be a validator to earn).

Things to Know Before Buying Terra (LUNA)

Since the relaunch of LUNA 2.0 in late May, investors have moved to participate in LUNA 2.0 to recoup some of their losses from the original token.

If you decide to invest, here are a few things you should know about Terra (LUNA) to help you make a more informed purchase decision:

- The architecture of Terra (LUNA) allows its consensus protocol to mine LUNA into various Terra stablecoin denominations.

- The LUNA-to-Terra mechanism aids in the adjustment of Terra LUNA prices in DeFi markets.

- Governance and staking are executable in the blockchain using LUNA tokens.

- Terra (LUNA) is a leading decentralized blockchain in South Korea.

- It’s currently listed in only a few exchanges.

Terra has the potential to expand further. As cryptocurrencies are high risk, you should still be prepared for volatility and the possibility of losing money. However, if you like what Terra offers, it’s worth adding to your portfolio.

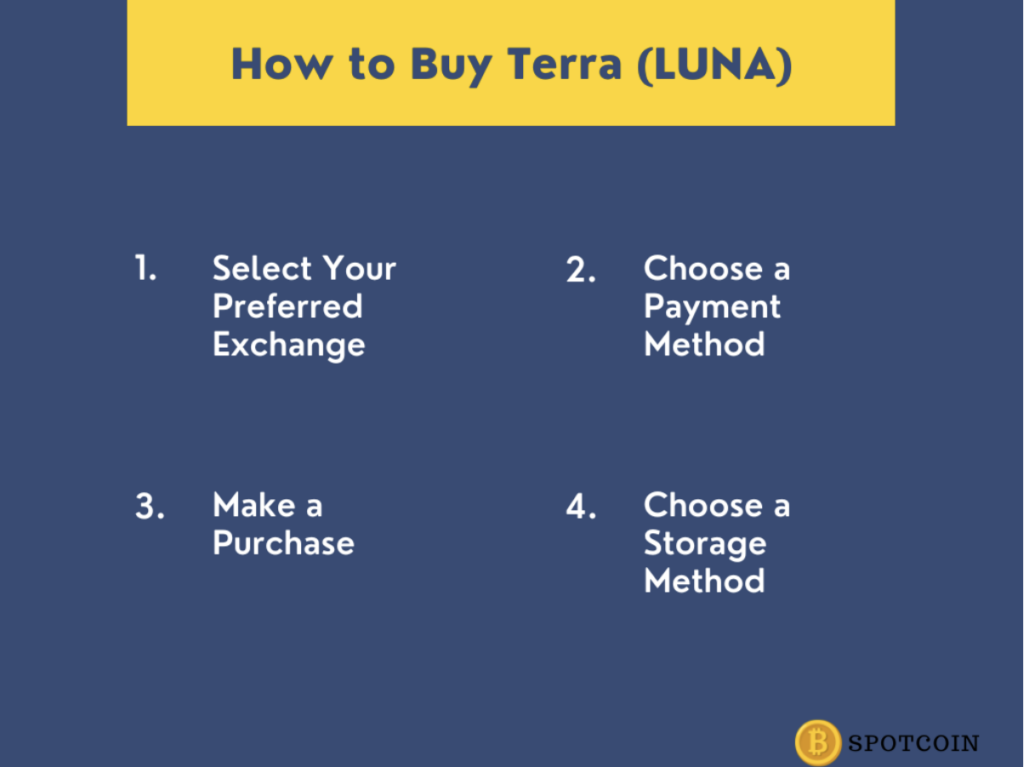

How to Buy Terra (LUNA)

Terra LUNA is one of many leading blockchain networks that saw a significant price drop during the first quarter. The cryptocurrency hasn’t entirely broken into the top 20 by market cap, but the Terra blockchain is already one of the biggest. Revenue numbers from Token Terminal have Terra in the top five. Let’s go over how you can buy Terra.

Select Your Preferred Exchange

This is the first and most delicate step in purchasing LUNA. Different exchanges provide varying levels of trust, fund security, transaction fees, and returns. As a result, discovering their operation methods can significantly impact how things turn out for your investment.

However, notable trustworthy exchanges for purchasing LUNA include eToro, Binance, and KuCoin, all of which provide high security, low transaction fees, and competitive returns, as well as value-added services such as analytics tools and research guides.

Choose a Payment Method

Most exchanges accept bank transfers and credit and debit cards. Bank transfers are the most cost-effective and widely accepted payment method. Some exchanges charge fees for card payments. PayPal isn’t widely accepted.

Exchanges generally don’t charge fees on direct bank transfers, making them the cheapest and most straightforward way to pay. Fees for credit and debit card payments are standard, plus not all card issuers allow you to pay by credit card.

PayPal

LUNA can be purchased using PayPal, which allows you to exchange fiat currency for cryptocurrency tokens. However, because PayPal is not a third party in most exchanges, you may not find this option limited.

Bank Cards

You can also buy LUNA with a credit or debit card. This is widely accepted across platforms and is appropriate for exchanging fiat currency for Terra LUNA tokens.

Cryptocurrency

Because of its interoperability, you can purchase LUNA by transferring any blockchain tokens: Solana, Ethereum, Dogecoin, XRP, and Bitcoin.

Make a Purchase

Once you’ve decided on a suitable exchange to purchase your LUNA tokens, go to the exchange’s dedicated LUNA page and enter the amount you want to invest. Due to the integration of LUNA Classic and LUNA 2.0, you may need to double-check your tokens before paying to ensure they are registered in the new blockchain.

Choose a Storage Method

You have two options when purchasing cryptocurrency and storing it yourself. You can keep your cryptocurrency in either a hot or cold wallet.

Hot Wallets

A hot wallet is a cryptocurrency wallet that is always online. It enables you to store and receive cryptocurrency. It is vulnerable to attacks because it is always connected to the internet.

Cold wallets

Cold wallets are safer than hot wallets because they lower the risk of fund loss. This is because cold wallets keep your tokens offline. Hackers can attempt to steal from your wallet if your wallet is connected to the internet.

The Bottom Line

Since 2019, LUNA has surpassed expectations in the blockchain. The token maintained consistent growth and correction even during the most challenging market conditions. Terra has acknowledged its errors, and the concept of Terra 2.0 shows that it has already begun to move away from the previous flawed concept.

Terra 2.0 may not have a revolutionary idea, but it abides by cryptocurrency fundamentals. Even though this is not financial advice, we believe it is worthwhile to give Terra a second chance, given Terraform Labs’ rousing support and contribution to the community.