As the 2022 bear market gyrates into the 2023 global recession, is bitcoin, gold, or the US dollar the most defensive choice?

A deep and severe recession could be coming next year.

Already, the best growth stocks have taken a significant hit. Market leaders including Apple, Amazon, Alphabet, Meta, and Tesla have all seen share price collapses, in some cases by more than 50%. And a recovery to new highs seems a long way off, given falling revenue announcements through Q3.

The global economy is reeling. And the post-pandemic recovery, Ukraine War, rising inflation and interest rates, Sino-US political tensions, supply chain challenges and labour shortages are all contributing to the wider economic downturn.

Of course, a recession every couple of decades isn’t a design flaw, but a system feature of cyclical capitalism.

For context, the UK entered recession in 2020, 2008, 1990, 1980, 1975, 1973, 1961, 1956, and then every few years going back to the 60 year-long ‘Great Slump’ of the 15th century.

But this needn’t be a disaster for shred investors. Falling equities, commodities, and home prices can provide opportunities for the level-headed trader with a reasonable risk appetite and excess discretionary income.

Of course, with UK CPI inflation at 10.1% and rising, many investors want to park their money into defensive options before attempting to time the dip at the bottom.

Gold

Gold — one of the earliest sources of money — has always been the traditional real asset inflationary hedge in times of severe economic stress. At £46,059/kg, it’s surfing close to its record £49,885/kg of July 2020 during the darkest days of the early pandemic.

Of course, the precious metal pays no interest, and returns no dividends. As Warren Buffet has often argued ‘it doesn’t do anything but sit there and look at you.’

However, this argument can act as a red herring during recessions. In 2008, the US economic benchmark S&P 500 fell by 37%, while gold rose by 24%. The index is down 20% year-to-date, and if the recession is at least as bad in 2023, gold could become even more attractive as equities sink further.

Of course, gold then underperforms when the recovery gets underway, with a bottom that’s close to impossible to time.

US Dollar

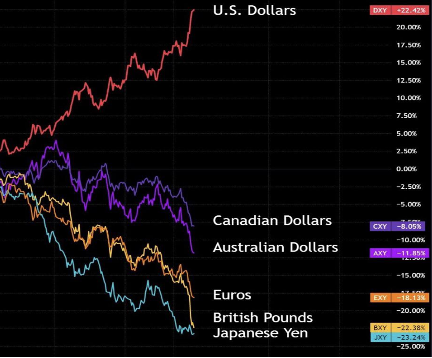

The US dollar represents the second traditional inflationary asset hedge. Despite printing trillions of dollars during the pandemic, increasing the Federal Reserve’s balance sheet to $9 trillion, much of the cash exiting equities is seeking the safe haven of the global currency.

Of course, the Americans weren’t the only ones to print hyper-excessive fiat. And with the Reserve determined to increase interest rates until inflation gets back to its 2% target, the US dollar could keep increasing further as investors benefit from both the increased nominal return and relative strength compared to international peers.

Importantly, higher interest rates usually draw gold investors towards the currency, weakening the metal’s outlook.

But there is a catch with dollar investing. When the recovery comes, investor cash will rapidly drain out of the currency to seek rapid growth returns within the equities market.

Bitcoin

However, unlike 2008, there’s another inflationary hedge for investors to consider through 2023’s downturn. Unlike gold and the US dollar, bitcoin has crashed in 2022, down by more than two-thirds since this time last year to just above the symbolic $20,000 resistance level.

More closely following the US equities market than either of the other two inflationary hedges, investors are naturally cautious about piling into the volatile cryptocurrency.

However, with many of the most reputable blue-chips in a bear market, the argument that bitcoin is more volatile than traditional assets is now treading on thin ice.

Bitcoin is naturally deflationary — only 21 million will ever be mined — and the crypto sector in general is undergoing significant regulatory reform, which could send the alternative investment to record highs when the bear market concludes.

There’s also the altcoin crash to consider; with far less money around, many of the hundreds of altcoin projects could collapse, and bitcoin, by far the largest crypto by market cap, could be the ultimate beneficiary.

Another interesting possibility is that the recession becomes so severe that it forces the Federal Reserve to pivot on monetary policy, which could also drive bitcoin to new highs.

Of course, only volatility can be reliably guaranteed. But a mix of all three may constitute sensible asset location for the defensive investor waiting to buy back into risk.

This article has been prepared for information purposes only by Charles Archer. It does not constitute advice, and no party accepts any liability for either accuracy or for investing decisions made using the information provided.

Further, it is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.